You’ve no doubt seen the signs that say, “Bad Credit? No Problem!” But, what exactly is bad credit? It can be hard to quantify, and there are many variables that go into determining its different levels. Let’s look at a few of them.

Standard Definitions of Bad Credit

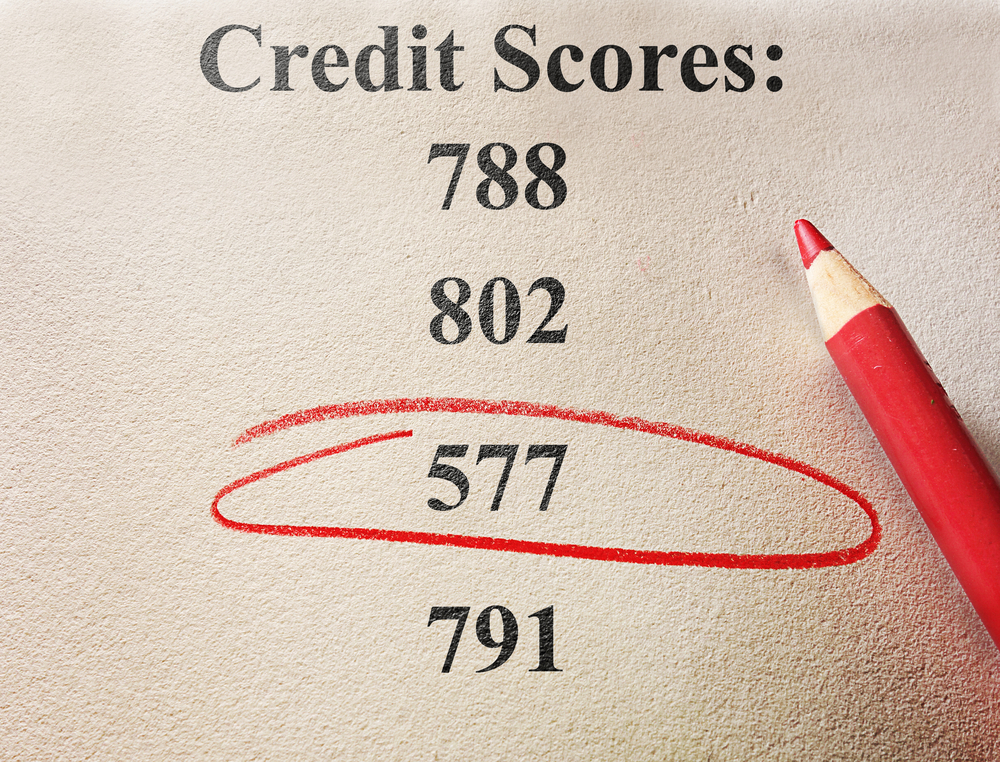

It can be downright puzzling trying to figure out what “bad credit” really means. On some credit score breakdowns, a score of 300 to 499 is considered a bad credit score, while a poor credit score extends from 500 to 599.

It may seem silly to differentiate between “bad” and “poor,” but someone with a score of 599 might get an approval while someone with a 350 might get denied from the same lender.

Things get complicated further because of the three different credit bureaus and the way each determines creditworthiness in their own way. There’s also different types of lenders, each with their own concept of what constitutes “bad credit.”

Traditional Lenders

Most of the best rates from the biggest lenders end up going to those with the strongest credit. In fact, many banks will not even lend to someone unless they meet their strict credit requirements. They play it safe because they want to make sure they will be paid back on time and in full. They are very risk averse and unwilling to budge when it comes to someone with less-than-perfect credit.

If you go to one of these lenders, they may tell you that “bad credit” is anything less than good or great credit. They don’t want to hear the story behind how your score got the way it is, and they won’t offer you much wiggle room.

Special Financing

Despite the workings of traditional lenders, there are several used car lenders that make it their business to lend money to those that otherwise can’t get approved for an auto loan. These lenders will look at your credit rating differently. “Bad credit” doesn’t look as low to them as it does to some of the big banks.

In most cases, these lenders are taking on much more of a risk, so they can charge higher interest rates. The worse the credit, the higher the rate. However, you may be able to find a wide range of interest rates from different lenders based on your credit report. It’s a great idea to choose a dealership that works with many lenders so that you know you’re getting the best rate for your individual situation.

What Makes Credit Bad?

There are some obvious negative marks that will give you a low credit score or a bad rating, like a foreclosure, bankruptcy, or repossession. Of course, paying late, not paying at all, having accounts that have been charged off, or having a court judgment will all bring down your credit score, as well.

Getting Back on Track

Lowering your credit score is easier than raising it back to where you want it. While it may take only a few months to take a hit to your score, it could take a year or more to recoup the loss and get back to where you were.

To get back on track, you must do the opposite of what you did to lower your score. Making payments on time, paying off credit card balances, and freeing up some of the credit you have available to you are all good places to start. It does take time, but in the end it’s worth it. You’ll not only save money on interest and fees, you’ll be able to get approved for more things at more places.

Choose the Right Dealership

Going with a dealership that works with people who have credit that’s lower than average is a good way to get a used car without suffering from having a bad score. Some dealerships have access to lenders that others don’t. That can make a real difference when it comes down to driving away in your next used car.

At Ride Time, they understand that you want a great car without paying extra because of bad credit. They will work with you and use their unique blend of lenders to not only get you approved, but get you approved in your own name so that you can start to turn things around. Visit Ride Time now, and see just how easy they can make it.

No Comments